How do you calculate the time required to recover your invested cost in PV?

I just got a quote for home rooftop PV without storage. The company said that they calculate between 7 and 9 years to pay back. I did the math myself with rosy assumptions and got >12 years.

My assumptions were:

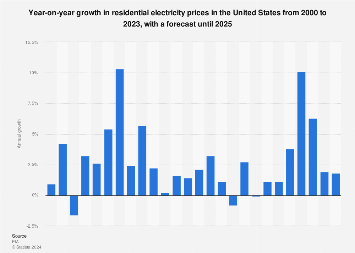

I found a website that shows nation-wide electric rates having gone up 2.5% per year over the past 25 years, but also predicts virtually flat electric rates for the future 25 years. I have no idea if the people behind these websites are reputable, but no one can predict the future. Also, "national" statistics don't represent my specific location.

Thank you for your thoughts.

I just got a quote for home rooftop PV without storage. The company said that they calculate between 7 and 9 years to pay back. I did the math myself with rosy assumptions and got >12 years.

My assumptions were:

- The PV system reduces my electric bill to just the standard base charge;

- The standard base charge doesn't change with netmetering; (*)

- No change in electric rates over time;

- No interest on my money if not invested in PV; (*)

- No change in homeowner's insurance cost; (*)

- No maintenance costs; and

- No REC payback (it's not offered where I live).

I found a website that shows nation-wide electric rates having gone up 2.5% per year over the past 25 years, but also predicts virtually flat electric rates for the future 25 years. I have no idea if the people behind these websites are reputable, but no one can predict the future. Also, "national" statistics don't represent my specific location.

Thank you for your thoughts.

Comment